- UAN Number

What is UAN number?

UAN is Universal Account Number. The UAN is a 12-digit number allotted to employee who is contributing to EPF. Universal number is a big step towards shifting the EPF services to online platform and making it more user-friendly. Please note that

The universal account number remains same through the lifetime of an employee. It does not change with the change in jobs.

Importance of UAN number:

Once you have the UAN number and you register it then you can check many details . Benefit Of Registration of UAN at UAN Member e-Sewa Portal are as follows:

- You can download the updated EPF passbook. The passbook will tell you the EPF balance broken into Employee Contribution(EE) and Employer Contribution (ER). Also deduction fro Employee Pension Scheme (EPS). Sample passbook is shown below.

- You can link your previous PF accounts (before Oct 2014) which are not linked to UAN number.

- You can upload KYC data.

- You can change mobile no and email address.

- In Future You can apply for the online PF transfer through UAN itself. Currently it’s a separate process done through Online Transfer Claim Portal (OTCP). Going forward plans are that when employee changes job and new Member ID is allotted then transfer of old Member Ids would be done automatically.

What is Member ID?

Employer submits the EPF(Employee Provident Fund) money to the EPFO (Employee Provident Fund Office) on behalf of the employee. This includes both the employee contribution, employer contribution, Employee Pension scheme. Member Id or Member Identification Numbers is the number given by EPFO to allow the employer to submit EPF money of employee. It’s like Employer opens an EPF account for its employee and contributes to that account every month. Member ID is the account number of employee in the EPFO. When the employee changes the job then the new employer will open a new account number for it’s employee in EPFO. So a new Member ID will be allotted to employee. Member ID is same as PF number earlier. So you would have as many Member ID’s as the number of employers contributing on your behalf to EPFO.

Member ID or PF Account Number is in the format given below. PF Account Number may not have Extension code. Ex: For someone who works in Bangalore the code can be BG/BNG/012345//789.

EPFO Office Code/Establishment Code (Max. 7 Digits)/Extension (Max. 3 digits)/Account Number (Max 7 digit)

How does Member ID differ from UAN number?

An employee will have one UAN or Universal Account number, which as the name implies will remain the same. It will maintain all your Member Ids. Its like you can have

multiple Saving Bank account but all these are tied to your one

Permanent Account Number or PAN. So when you change your job and the new employer, if contributing to EPF, gives you a new Member ID. This new Member ID has to be linked to your UAN number.

- If the employee does not have a UAN number, probably because it’s his first job or he was working before Jan 2014 when UAN number process started. Then employer will request the EPFO to generate the UAN number for its employee along with Member ID.

- For an employee who already has a UAN number the employer will submit the request to EPFO to generate new Member ID for the employee and link it to the UAN number of the employee by filling Form 11.

How is UAN number allotted?

- The EPFO will allot employers the universal numbers of all employees for which employer makes EPF contribution.

- If the employee does not have a UAN number, probably because it’s his first job or he was working before Jan 2014 before UAN number process started. Then employer will request the EPFO to generate the UAN number for its employee along with Member ID.

- For an employee who already has a UAN number the employer will submit the request to EPFO to generate new Member ID for the employee and link it to the UAN number of the employee by submitting Form 11 filled by new employee.

- The employer would then give the number to its employees, who need to provide their KYC (know-your-customer) details to the employer.

- The KYC details of employees would then be updated online on the EPFO website by the employer.

- An employee can also upload the scanned copy of the KYC document through the EPFO website once you are done with the UAN-based registration. However, your employer has to digitally verify your KYC details.

- Every UAN will be linked to one or more Member Ids up to maximum of 10. It would help to track the EPF contribution throughout the entire career

How to check status of UAN Number Online?

You can use the link EPFO:Check UAN Status to verify whether UAN is allotted to you or not.

On Checking status I get Request for this Member ID is already under process. What does it mean?

When one checks the UAN status one might see message similar to Request for UAN for this Member Id ABC is already under process.(through ECR) since last 45 days.

This means that the UAN process for Member ID is processing and your UAN number will soon be generated. How soon, is anyone’s guess,It can take around 2 months, but With EPFO embracing technology it would become faster as time progresses.

What is registration of UAN number?

To see the details Once you receive the Universal account number or UAN from your employer, you have to log on to the official website

http://uanmembers.epfoservices.in. Click on

Activate UAN Based Registration and enter your UAN, mobile number and member ID. Once you are registered you can download your UAN card, EPF passbook, link earlier PF Member Ids etc. Our article UAN or Universal Account Number and Registration of UAN explains the process in detail.

On trying to Activate UAN I get message Mismatch in UAN and Member ID? What does it mean?

When one tries to activate the UAN one might see message similar to Mismatch in UAN and Member ID .

It means that the Member Id being used for Activation of UAN number and Member ID associated with UAN number does not match. It may be due to incorrect filling of Member Id. Member ID or PF Account Number is in the format given below.

EPFO Office Code/Establishment Code(Max. 7 Digits)/Extension(Max. 3 digits)/Account Number (Max 7 digit)

Some tips while entering Member Id

- Please select check box near I have Read and Understood the Instructions. (marked in Red color in image below) to see the form

- By Selecting State and Office EPFO Office Code automatically gets filled. In case your office has multiple branches Your state may not be where you work but where your main office is situated. For example for a company with head office in Noida and branches in Pune & Bangalore. The EPF for all employees might be done at one place where the first office is situated, Noida in our example. Then even for employees in Pune and Bangalore the State to be selected is Uttar Pradesh and Office Noida.

- If your PF number does not have Extension Code leave it blank.

- UAN Number

What about KYC and UAN?

KYC is an acronym for Know your Customer or Know your client. It refers to due diligence activities that financial institutions and other regulated companies (LPG,telephone) must perform to ascertain relevant information from their clients for the purpose of doing business with them. Our article Know Your Customer or KYC talks about KYC in detal.

Basic purpose of KYC is to verify that you are what you are claiming to be. So your UAN number also needs KYC. KYC status is reflected in UAN card. There are two ways that KYC for UAN can be done

- Your employer asks you for KYC document and uploads it on your behalf.

- You upload scanned copy of KYC documents and employer approves it. It can be done by going to the Profile menu and selecting Update KYC Information in the Member Portal. The uploaded KYC document by the member will be approved by employer till then status of KYC will be shown as Pending. You need to scan the KYC document first and save it as .jpg/.gif/.png/.pdf. The size of scanned document should not exceed 300kb. multiple KYC documents out of the 8 specified KYC documents can be uploaded.

Following documents can be used for KYC:

- National Population Register

- AADHAAR

- Permanent Account Number

- Bank Account Number

- Passport

- Driving License

- Election Card

- Ration Card

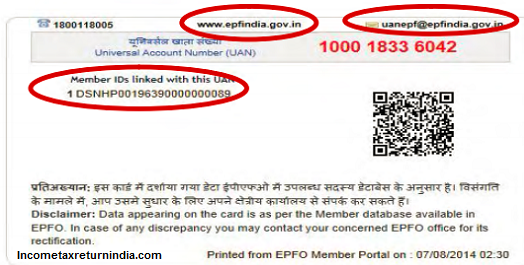

What is UAN Card?

UAN Card as the name implies shows the Universal Account Number and provides details related to UAN number. Its just like PAN card. Though it’s usage is still not clear.

- Front portion of the UAN Card displays : UAN, Name, Father’s/Husband’s Name, Member-ID, (as available in the EPFO member database) Photo and KYC. If KYC of this member is uploaded by the employer, it will reflect on the front side of the UAN card by displaying Yes in front of KYC else if will reflect No

- Back side of the UAN card displays latest five Member-IDs linked with this UAN along with help desk no. and email-id.

- UAN Number

- UAN Number

Change of Job and UAN number

What to do when one changes job. If Universal Account Number (UAN) s already allotted then one is required to provide the same on joining new establishment to enable the employer to in-turn mark the new allotted Member Identification Number (Member Id) to the already allotted Universal Identification Number (UAN). This is done by Filling the epf-New Form-11-with-instructions(epf) which replaces the old Form 11 and Form 13. The EPF circular of 2 Jan 2015 can be found here. Part of Form which refer to Previous Employment details and Declaration by previous employer are given below.

- UAN Number

- UAN Number

One can download the filled copy of the Form 11 from UAN website after login by Selecting Forms->Declaration Form and filling Date of exit of Previous Employment as shown in image below.

- UAN Number

- UAN-Detail

What if two UAN numbers were allotted to someone?

Yes there have been many cases when two UAN numbers were allotted to the same person. This was due to less awareness of the UAN number and during job change the new employer did not ask for UAN number or previous employer’s PF details. In such a case a person can have two UAN numbers associated in addition to two member IDs. In such a case, you are suggested to immediately report the matter either to your employer or through email to uanepf@epfindia.gov.in by mentioning your current and previous UANs. After due verification the previous UAN allotted to you will be blocked and Current UAN will be active. Later you will be required to submit your Claim to get transfer of service and fund to new UAN. How much time this would take we couldn’t find out. If readers can share their experiences with us it would be beneficial to others.

What is linking of Previous Member Id and UAN? Can one transfer claim through UAN

If you have only one UAN number but many Member Ids then you can link your previous member IDs with the present UAN number. This is useful when one needs to link one’s earlier PF account before UAN came into picture. Linking is the first step. Then one needs to transfer the earlier account . You can do so from UAN portal itself but it takes you to

http://memberclaims.epfoservices.in/. Process of transferring is explained in our article Transfer EPF account online : OTCP.

- UAN-Detail

Name or Father’s or Spouse Name name or Date of Birth is not correct in UAN

EPFO has made a provision for change the name of EPF members. Members who wish to get their name/Fathers name/Date of Birth to be changed in the EPF Database can apply for the same through their employer along with supporting documents. One can read EPF Circular for change in name and EPF Circular for change in birthday

Supporting Documents for change in Name/Father’s Name/Spouse Name may be one of following documents

- PAN Card

- Voter’s ID Card

- Passport

- Driving License

- ESIC Identity Card

- Aadhaar Card

- Bank Passbook Copy/Post office Passbook

- Ration Card

- Any school or education related certificate

- Certificates issued by the Registrar of Births and Deaths

- Certificate based on the service records of the Central/State Government organisation

- Copy of electricity/water/telephone bill in the name of claimant

- Letter from recognised Public Authority or public servant verifying the identify and residence.

Supporting Documents for change in Birthday may be one of following documents

- Birth certificate issued by the Registrar of Births and Deaths

- Education certificate/School record/leaving certificate

- Passport.

- Any other reliable document issued by a government department; but NO affidavit or court order merely based on member’s declaration only.

- Certificate based on the service records of the Central/State Government organisation